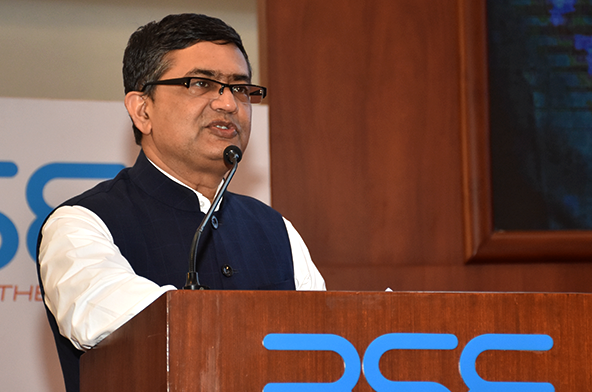

"We had taken note of Moneylife Foundation's Report on Retirement Homes and had completed consultation process. In few days, I am going to write to chief ministers of all states and soon we will issue guidelines for retirement homes in India," says Hardeep Singh Puri, Union Minister of State for Housing and Urban Affairs (Independent Charge). He was speaking at the 9th Anniversary of Moneylife Foundation at Mumbai.

He said, "We are happy to use the Report and follow up notes shared by Sucheta Dalal, Founder-Trustee of Moneylife Foundation and carried out due process. The process has not gone past draft and consultation. Since property matters are state subject, soon I will be writing to CMs of all states with our guidelines." (Read: Regulation of Retirement Homes under Consideration)

While taking about urban landscape and heritage, Mr Puri said, "Indian cities suffered due to earlier policies that were focussed more on rural civilisation, though cities have been the backbone for the our economy for centuries. When India became an independent country, 17% of our population of 300 million lived in urban areas. As per the 2011 Census, 31% of a 1.25 billion population lives in urban areas. The rate at which we are urbanising, there will be 600 million people living in urban spaces by 2031. India's gross domestic product (GDP) from agriculture is just 13%-14%, while the same from urban areas is almost 60%. Most of India lives in rural areas but the contribution of agriculture to the GDP is very small. This in other words mean, people from the rural areas leaving their shelters behind and are picking up their bags and heading to wherever there are economic opportunities. Now, there is a choice. You can have 600 million people living in dire conditions or you can have planned urbanisation."

Citing examples of Ujjain, Dwarka and other historical cities, Mr Puri says we have been building Smart Cities for thousands of years our forts, palaces, the technology used to keep them cool. "Where all of this has gone? What we did wrong? Especially, after Independence what we had done to at least maintain our heritage in planning and development of cities," he asked.

He says, "We were not smart enough to realise the potential of what urbanisation could bring about, one of the most significant new development that took place recently is the embracing of urbanisation. This government is investing and spending more in cities than has ever been done in this country."

Focusing on the ultimate aim for improving the ease of living, and consequently the quality of life for each and every city-dweller of India, the minister said that all initiatives by the government, the missions and programmes are aimed in that direction. The investments required in urban areas for a 20-year period between 2012-13 and 2031-32 is estimated to be Rs39 lakh crore.

The 90 "smart cities" selected so far have indicated a total investment of Rs1.9 lakh crore in their proposals. The central government would be giving financial support to the smart cities mission to the extent of Rs48,000 crore over five years - that is Rs100 crore per city per year for development of 100 cities throughout the year.

Mr Puri also highlighted importance of the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) scheme launched by Prime Minister Narendra Modi in 2015. AMRUT scheme focuses on establishing infrastructure that could ensure adequate robust sewage networks and water supply for urban transformation by implementing urban revival projects.

Talking about Real Estate (Regulation and Development) Act (RERA), the minister said, "It has been 70 years since Independence and we did not have an independent regulator before (RERA). Nowhere in the world have I come across a situation where a sector as big as the real estate does not have a regulator. For eight years this legislation was lying around."

"Since realty is a state subject, implementation of RERA is their responsibility. So RERA is not successful in all states and some states, including very progressive in other matters, are lagging behind in bringing transparency in real estate regulation. However, we are receiving very good response of MahaRERA," Mr Puri says.

Replying to questions after his speech, the union minister also highlighted the importance of public transport. He says, "We are focussing more and more on moving vehicles. Cars are moving but not people. There is no decision making in public transportation. For example, we have been requesting the Delhi government to buy new buses for public transportation, but they are not taking the decision. We feel people should be given choice and for that public transportation plays and important role."

During the program, Mr Puri also released Moneylife Foundation's "Study Report on Reverse Mortgage". The study report is supported by Housing Development Finance Corp (HDFC). Two bankers, Shrinivas Marathe and Pradeep Bhave did the research for the Study.

"Due to poor financial literacy and extremely high property prices in India (relative to the income levels), millions of savers are likely to retire with a large chunk of their savings locked up in the apartments that they live in. They may not be poor in terms of net worth, but would not have the cash required to meet the rising cost of retirement living. In other words, they would be asset rich but cash poor. This is where Reverse Mortgage Reverse Mortgage is useful," the study report says.

A reverse mortgage is a type of home loan for older homeowners that requires no monthly mortgage payments but gives them a monthly payment instead.

The study report includes the demand and supply scenario, analysis of the currently available reverse mortgage products, analysis of the present regulatory framework, misconceptions about the scheme and incentives required to make reverse mortgage a popular product for both customers and banks, and how reverse mortgage schemes can be made affordable and popular among borrowers and lenders.