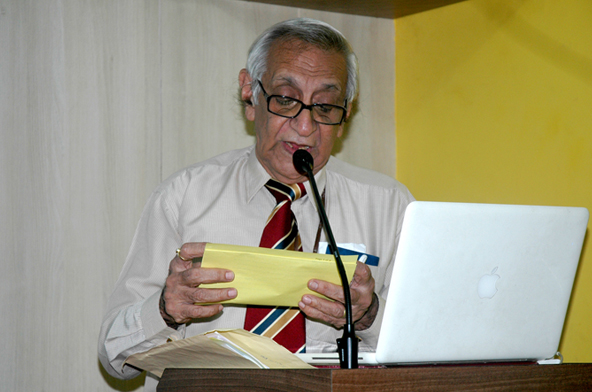

In an interactive session at Moneylife Foundation, Advocate Bapoo Malcolm explained to a packed house the practical aspects of making a will and importance of registering your own Will. This was Adv Malcolm’s fifth session on Wills at Moneylife Foundation.

Mr Malcolm, advocate, Bombay High Court, a man of many interests and the speaker for the workshop, covered issues related to Wills, like registration, litigation possibilities, witnesses, executors, intestate problems and adoption. He also discussed types of wills, including privileged wills, joint wills and holographic wills.

Talking about Wills, the well-experienced lawyer in both civil and criminal matters, said, “A Will can be made by any person who is not a minor and who is of sound mind. You need two witnesses, preferably independent of each other. The Will must list all the immovable and movable properties you own, and who you wish to will them to after your death. However, remember, you can only bequeath what belongs to you and what is self-earned; otherwise the distribution is governed by various Succession Acts.”

Adv Malcolm, then explained the technicality of the subject – testators, codicils, executors, probates, administrators and the various succession acts – with real-life examples that elucidated the complicated topic of wills to the audience.

Explaining the simplicity of creating a Will, Adv Malcolm said, “A Will is a simple document to be written in simple language. Preferably, avoid legalese. You simply have to give specific instructions about what has to be done with the movable and immovable properties you own and the property you might acquire in future. It would be best if it reads like a balance sheet. Just specify the property and the person. A Will should be legible and clear to understand.”

The religion of an individual matters for succession under the Hindu Succession Act, Muslim personal law, Parsi personal law, Christian law and for others by default under the Indian Succession Act. Each category has different tables for arriving at legal heirs in the absence of a will. ‘Hindu’ has a broad meaning because anyone who is not Muslim, Christian or Parsi is categorised under the ‘Hindu’ category, he added.

A Will needs to be clear and concise, leaving no room for misinterpretation. “A Will would be interpreted according to the word of the law, which may not assign the same meaning as you intended.”

For example, while mentioning names it is important to specify the relationship along with the date of birth of the person, as there could be common names. In addition, if you wish to intentionally leave someone out of your Will, especially, if it is a close family member, it is better to mention the name in the Will. If not, the person may contest the Will by saying you have forgotten his/ her name, Adv Malcolm explained.

While preparing a Will people are often left confused about its registration. Clearing the doubts and misconceptions about Wills, Adv Malcolm, said, “The government does want to encourage people to make Wills, so they haven’t made it compulsory to register a Will. You can even make a Will on a serviette. So long as the basic requirements are fulfilled, the Will is legal. Registration is a grey area, mainly because if you then wish to make a second Will, you may not have the time to register it. If you realise the day you die that a relative is useless, you may not be able register this second Will. Then, does the unregistered Will have more value than the registered one? An unregistered Will could easily be lost; however, registration takes care of the safety issue. At least, if it is registered, you know that it is always in some government ward.”

He then explained about probate, which is validation of a Will by the Court. “Probate is required only in Presidency States of Bombay, Chennai, Kolkata and only within their jurisdiction only for immovable property. Companies prefer to recognize Wills that are registered or sometimes require a probate. In addition, transmission of immovable property also usually requires a probate,” he added.

Adv Malcolm then explained Trust, which is used for complex bequests and special cases. He said, “A Trust can be registered under the Indian Trusts Act. You can transfer funds and property to the Trust, which becomes the holding vehicle. Trustees manage the Trust as per the Trust Deed. You can access and control assets while alive and decide on distribution too. A Trust protects your assets from probate.”

Citing several examples, Adv Malcolm also explained several things that need to be avoided while preparing a Will.

Adv Malcolm also answered the queries of Moneylife Foundation members who raised their doubts.