Moneylife Foundation conducted another seminar on retirement planning and investing, where Sucheta Dalal, managing editor of Moneylife and founder trustee of Moneylife Foundation, spoke about ‘Safe Investing and how not to lose money’ and Debashis Basu, editor and founder trustee of Moneylife Foundation, discussed about ‘Smart Investing’.

First session was taken by Sucheta Dalal. She explained that they have to plan to care for their heart, knees or teeth in their old age. Savings should be enough to cover their expenses for another 20-30 years; however, income from savings fluctuates with interest rates. Senior citizens need to be prepared for medicare, insurance and cost-of-living. She made the audience aware about the five principles of safe and smart investments–

1. Avoid losses

2. Avoid Financial and emotional traps

3. Make safe and sensible investments

4. Strive for Financial independence

5. Plan for your loved ones.

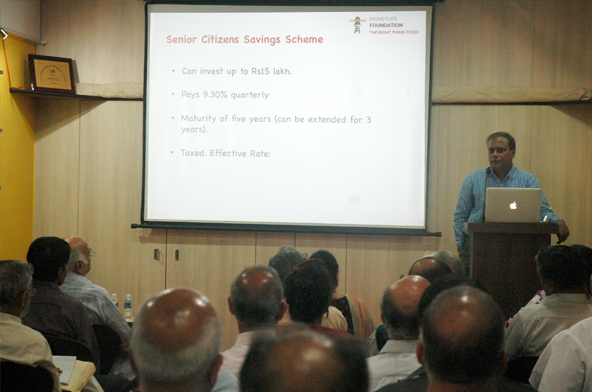

In the second session, Mr Basu explained that retirement planning can be complicated. There are hundreds of financial products available. However, to plan with them is tough because of one critical unknown – how long is the money needed. Mr Basu made people aware of the pros and cons of different financial products such as immediate annuities, Senior Citizens Savings Scheme (SCSS) and MIP schemes, but emphasised that none of these are great choices. In the post-retirement period, it is important to choose safe assets, for which bank fixed deposits are among the best but one can also pick from other options such as corporate bonds, short-term debt schemes of mutual funds and fixed deposits. For those in 20% and especially 30% tax bracket, an excellent option is listed tax-free bonds from government companies. However, investing all the money in fixed income products for the very long term may turn out to be imprudent because they do not beat inflation. Retirees may like to invest some amount of money in equity mutual funds, especially at the earlier stage of their retirement.

A more detailed report of the earlier seminar is available here: How to protect and grow your nest-egg post-retirement