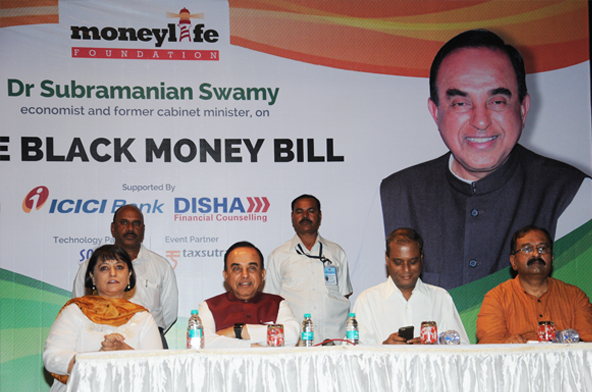

Dr Subramanian Swamy, the leader of Bharatiya Janata Party (BJP) said, “The Black Money Bill tabled in the Parliament is not sufficient to eliminate the problem. In addition, there is nothing in the Bill on bringing back black money in India”. He was speaking on the new Black Money Bill tabled last month in the Parliament.

The KC College auditorium where the programme took place was filled to the capacity. The attendees included many eminent lawyers, chartered accountants and senior consultants as well.

Dr Swamy while elaborating on how the black money can be used, said, corruption had affected the economy, politics and national security.

“Apart from bringing back the black money we need to prevent its creation. Abolishing participatory notes (P-Notes), personal income tax (I-T) and registration charges for real estate is one of the ways to curb creation of black money.” Dr Swamy said.

The Black Money Bill, tabled in the Lok Sabha last month, provides a short window to income tax assesses to declare assets, pay tax and penalty and avoid imprisonment. The Black Money Bill appears simple and comprehensive. It has adopted a carrot-and-stick approach. It provides a limited, one-time compliance opportunity to come clean on payment of a gross tax of 30% and an equal penalty.

The Narendra Modi government proposes to make the Bill effective from the assessment year starting April 2016. The Foreign Income and Undisclosed Assets (Imposition of New Tax) Bill, 2015 provides for a maximum of 10 years rigorous imprisonment for offenders who evade taxes in relation to foreign assets.

As per the Bill, concealment of foreign income and assets will be non-compoundable and offenders will not be permitted to approach the Settlement Commission for resolving disputes. There will also be a penalty at the rate of 300% of taxes on the concealed income and assets. The Bill seeks to make non-filing of income tax returns or filing returns with inadequate disclosure of foreign assets liable for prosecution with punishment of rigorous imprisonment up to seven years.

However, the Black Money Bill does not seems to cover everything that it should. For example, there is no direct mention about those who have become citizens of countries like Macedonia, Bulgaria, Montenegro and Romania but continue to live and operate in India like Indian citizens. In addition, the definition of what is ‘normally resident in India’ and what constitutes ‘place of effective management’ and its interpretation is not clear enough. If tax officials are allowed to decide this at their discretion, it could have serious implications for foreign companies with significant Indian operations. Not to forgot the powers that the revenue authorities may obtain after the passage of the Bill.

Dr Swamy said, “I agree that the Bill contains some harshness and based on assumptions powers may be misused by revenue officials. The Bill is more like an I-T Bill and de-facto amnesty scheme. The amnesty would also be dropped and in the end it will be just empowerment of I-T officials.”

Earlier in a Facebook post, Dr Swamy had said investing black money in Indian markets creates inflation. “The market has started to focus mostly on luxury goods and premium segment services; leaving the underprivileged out. The high realty prices and inflation are all symptomatic of this trend,” he added.

According to the former cabinet minister, some of the black money is sent abroad, while some kept here in India and spent on buying and developing land, especially for building luxurious houses with Italian marble. Another way to spend black money was through participatory notes (P-Notes), where money deposited abroad is brought back to Reserve Bank of India as P-Notes and invested in the stock markets.

P-Notes have been accounting for mostly 15-20% of the total foreign institutional investors (FIIs) holdings in India since 2009, while it used to be much higher, in the range of 25-40% in 2008. It was as high as over 50% at the peak of Indian stock market bull run in 2007.

According to the data released by Securities and Exchange Board of India (SEBI), investments into markets through P-Notes surged to the highest level in over seven years at Rs2.72 lakh crore (over $43 billion) in March 2015. The total value of P-Note investments in Indian markets (equity, debt and derivatives) rose to Rs2,72,078 crore at the end of March from Rs2,71,752 crore in the preceding month, the data says.

Few years ago, the BJP leader had claimed that “black money is no more in Swiss banks”. However, no one believed him at that time.

Dr Swamy had said the best way forward was to take recourse to the United Nations Convention on Corruption to instruct the tax havens to cooperate. He recalled that in October 2014 he had written to Prime Minister Modi listing six steps through which the government could bring back black money, pegging the amount at about Rs1.2 lakh crore. He had suggested an ordinance declaring all illicit wealth stashed away abroad in tax havens as national wealth. “Under the United Nations Convention on Corruption, each of the countries can be directed to transfer the money back,” Dr Swamy said.

According to White Paper on Black Money in India report, published in May 2012, Swiss National Bank estimates that the total amount of deposits in all Swiss banks, at the end of 2010, by citizens of India were Rs92.95 lakh crore or $2.1 billion. The Swiss Ministry of External Affairs has confirmed these figures upon request for information by the Indian Ministry of External Affairs. This amount is about 700 fold less than the alleged $1.4 trillion in some media reports.

Main features of the Bill

• Maximum of 10 years rigorous imprisonment for offenders who evade taxes on foreign assets.

• Penalty at the rate of 300% of taxes on the concealed income and assets.

• Income from any undisclosed foreign asset or undisclosed income from any foreign asset will be taxable at the maximum marginal rate.

• Beneficiary of foreign assets will be mandatorily required to file return, even if there is no taxable income.

• Non-filing of income tax returns or filing or returns with inadequate disclosure of foreign assets liable for prosecution with punishment of rigorous imprisonment up to 7 years.