In the discussion that followed, a well know capital market commentator pointed how the stock price of tiny companies listed on the Indian market are routinely rigged up a few hundred times and then sold to a faceless FII usually based in Mauritius, thus allowing easy laundering of funds. Moneylife editor Debashis Basu pointed out how every issue of the magazine published examples of stocks that are so-ramped up by as much as 2,000% sometimes (under a section titled Unquoted). But four years after the magazine began to publish these brazen examples of manipulation, the regulator who has spent crores of rupees on market surveillance software has failed to act.

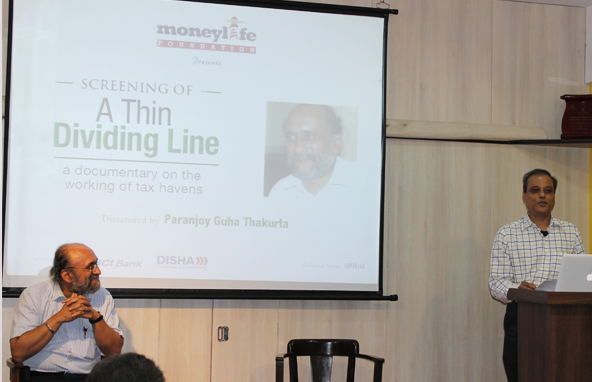

Well known independent journalist and educator, Paranjoy Guha Thakurta’s latest documentary, “A Thin Dividing Line” brings out how tax havens or low tax jurisdictions blur the dividing line between legal forms of tax avoidance, euphemistically called tax planning, and illegal forms of tax evasion or money laundering. The documentary was screened as Moneylife Foundation’s 200th event to an informed audience on 28th February, followed by a discussion with Mr Thakurta. The hour-long documentary includes views from high ranking Indian tax officials, academicians, politicians and an array of top Mauritian officials including its former prime minister on the infamous treaty signed in 1982.

Ever since Indian economic liberalisation in 1991, over 40% of investments via foreign institutional investment (FII) and foreign direct investment (FDI) have been routed through Mauritius. But why is Mauritius more popular than other tax havens? The film suggests it is the proximity to India and the fact that over 60% of Mauritius residents are from Indian origin. The corporates in Mauritius pay effective tax of 2%. In India, laws and rules have been created and defended ostensibly because these have helped attract foreign investments. However, India has not necessarily benefitted from all these foreign investments to the extent envisaged or anticipated. Greater transparency in financial transactions, stricter regulation and more effective implementation of existing laws are needed. Even if certain financial transactions adhere to the letter of the law, not all of these are desirable or beneficial for humankind.

With the treaty, India has given up its right to levy capital gains tax under article 13. Mauritius does not charge capital gains tax allowing foreign investors to take advantage of the treaty to avoid paying taxes. Mr Thakurta said, “An estimate done by a study puts a figure of many tens of thousands crores in loss for Indian exchequer.”

Mauritius authorities interviewed in the documentary talk about due diligence, compliances and safe guards to ensure clean business, the need for resident directors and other checks. However, it is an open secret that Mauritius is packed with ‘nameplate’ companies with top accountants and lawyers in India helping to set them up from India itself. The process of hiding the trail of beneficial ownership through layers of shell companies that sometimes transmit money through multiple tax havens is also well known to the government and Indian authorities.

Mr Thakurta’s film discusses “round-tripping” to make it legal. He says, “It’s not like laws in India cannot be enforced, but there are loopholes that are not plugged. Those responsible are incapable or deliberately not doing it.”