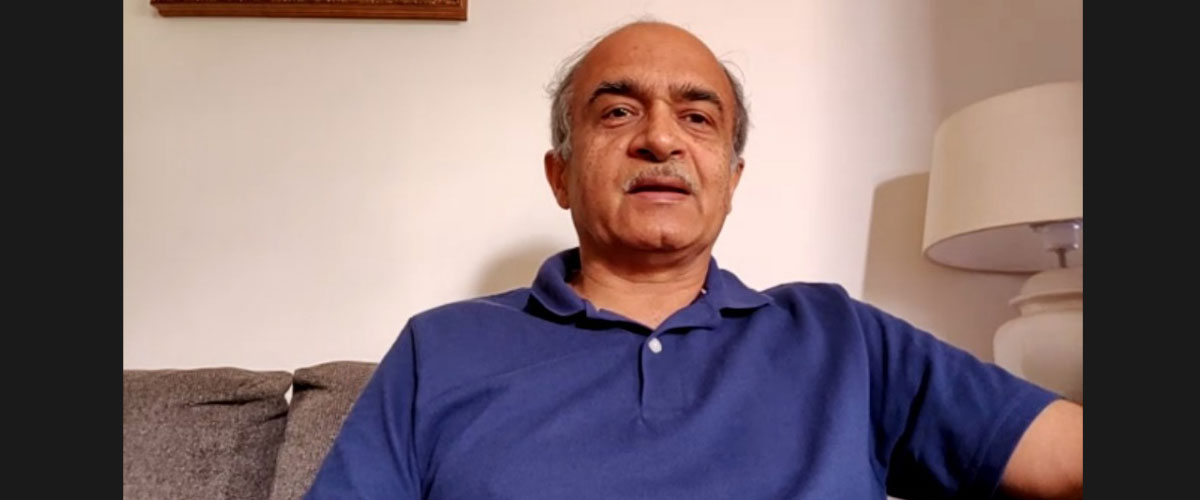

“We are faced with a very serious and difficult situation in this country, and in the entire banking sector as well. What we need, is to set a group of really engaged and concerned individuals, who take up these issues at various levels, including seeking information through Right to Information (RTI), taking the matter to court to seek accountability, and raising public outcry. Yes, I understand, it will be very difficult battle, given the kind of moral climate we are seeing in this country, but unless we can get more people aroused and unless we can get an organised movement going, we won’t achieve the change we seek,” said senior counsel Prashant Bhushan. He was speaking at a webinar organised by Moneylife Foundation, on transparency and disclosure in the banking sector.

The RTI Act was envisioned to bring in more transparency in the system but over the years, banks and especially the Reserve Bank of India (RBI) have found ways to ignore or sidestep even orders from the Supreme Court. Banks immediately rush to the Supreme Court seeking a revision of the order issued by the Central Information Commission (CIC) whenever the CIC ask them to disclose information that is supposed to be in the public domain.

Beginning his talk, Adv Bhushan spoke about the efficacy of the RTI Act and how it is one of the most efficiently drafted acts in the world. He also acknowledged that while the Act is well-drafted, there are certain exemptions, which can and have been used by public authorities to avoid disclosing information.

Speaking on a particular Supreme Court case, where RBI was taken to task for refusing to share information under the RTI Act, the senior counsel says, “What RBI had argued when the main case was heard, was that this information from the banks given to the RBI, has been given in a fiduciary capacity and a capacity of trust and since this is one of the exemptions available under the RTI Act, it cannot be given on these grounds. The other reason given by RBI was that a lot of the information contained would be private information relating to depositors and clients, and therefore privacy, which being another exemption, will also prevent the disclosure of this kind of information.”

As we know, Adv Bhushan says, the Supreme Court however refused that line of reasoning. “They rejected both arguments from RBI and pointed out, that there are a number of Bank scams going around, that banks are dealing with public money, that RBI is a regulatory body and authority, and under the law it has obligations to seek and collect information, and conduct periodic inspections of various banks etc. Therefore the information given by banks to the RBI in virtue of conducting routine inspections, is not in a fiduciary capacity,” he added.

The RBI had also argued using the privacy clause, stating that any inspection or audit reports submitted by banks to them on a routine basis, may contain some private or personal information which could not be shared.

However, Adv Bhushan explained, “If people have borrowed public money from the banks and thereafter defaulted on the same, then information about the loans they had taken, and their defaults cannot be said to be private information and then held as exempt under the RTI Act”.

Following Adv Bhushan’s presentation, Shailesh Gandhi, former Central Information Commissioner and well-known RTI activist shared his thoughts. He emphasised that “the first and fundamental principle of RTI is that we are a democracy and citizens are the rulers. Everything belongs to them, including the information.”

Of the 11 orders that were challenged in the Supreme Court regarding the RBI’s lack of transparency, 10 orders were passed during Mr Gandhi’s tenure as the central information commissioner. (Read: Active citizens, keeping tabs on the government, will lead to improved governance)

Referring to the clauses RBI had used while refusing to disclose information, Mr Gandhi argued that “if declaring the audit reports, inspection reports or defaulters lists of any particular bank is going to damage India’s economy, then our economy must be very frail. In fact, if it is frail, citizens of India have the right to know.”

“Reserve Bank is not expected to act for the benefit of the banks. They are supposed to act as a regulator. This is in my mind the fatal flaw in our entire system of looking at regulators. If I broaden the scope, most of our regulators do not do their prescribed job and believe they are independent kings in their domain,” he further added.

“Reserve Bank acting the way it is acting, is a very shameful thing,” Mr Gandhi says, adding, “Institutions are supposed to respect the law, they are supposed to act as role-models for others to follow.”

Following the talk, Sucheta Dalal, founder-trustee of Moneylife Foundation moderated a panel discussion, which was attended by many stalwarts from the banking sector and RTI activists including columnists Hemindra Hazari and R Balakrishnan, former central information commissioner Prof (Dr) Acharyulu and RTI activists Subhash Chandra Agrawal and commodore Lokesh Batra, among others.

Prof Acharyulu, who is also a legal luminary, shared his thoughts regarding the various Supreme Court cases against RBI in the matter of information disclosure under the RTI Act.

He says, “The systemic deficiency is problematic. We are not fighting for information only we are fighting to expose the corruption. That is the problem. So, inspection reports are just one part, if it reveals the inefficiencies of the regulator or if it will reveal the corrupt irregularities of the concerned bank; these are two factors which they are concerned in hiding and the fight to disclose this information has to continue.”

The talk was also saw attendance of Girish Mittal, who had filed the original petition in the Supreme Court on seeking bank inspection reports under the RTI Act, and Pune-based Vivek Velankar, who had filed a series of RTI applications with the banks to get details of bank write-offs and bad loans.

The webinar ended with concluding thoughts from Mr Gandhi saying, “Yes the times are bad. The Right to Information Act is one of the best laws in the world as far as transparency is concerned. We blame our politicians for everything that is wrong, but the parliament did give us one of the best laws in the world. Are we defending it adequately? Supreme Court may have had its problems, but I think we need to hang on as Adv Bhushan said. We are a voting democracy and if people persevere we would definitely see the change.”

A Video Recording of the Webinar Can be Viewed Below:

You can now get all your RTI related queries resolved with the click of a button. The Moneylife “RTI Advice” app is now live on the Google Playstore and the Apple App Store. So download now and ask all your RTI related queries now!