“Going green or paperless is great in terms of saving environment. However, unless you are careful and have preserved copies of your income and expenditure related transactions, electronically, you may attract the unnecessary attention of the taxman,” advised Chartered Account (CA) Ameet Patel. He was speaking on “Don’t fall victim to the taxman’s roving e-eyes and learn how to maintain tax papers in a paperless environment” a packed seminar organised by Moneylife Foundation and sponsored by Capital First in Mumbai.

“Till last year, there was a limit beyond which the Income-Tax (I-T) department could not reopen your past assessments. However, under the Income Disclosure Scheme (IDS) 2016, the tax department has no time limits and the taxman can go back to any number of years. Therefore, we need to save our important documents for posterity!” he said.

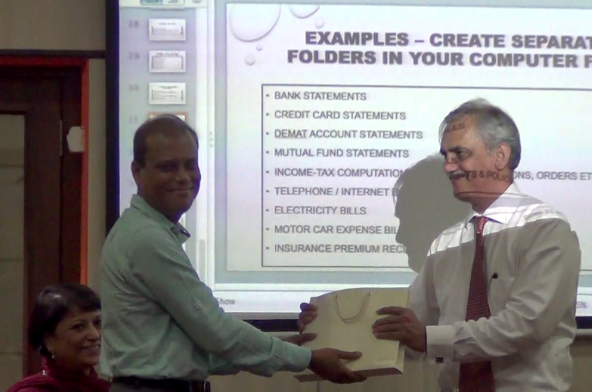

Mr Patel, former president of the Bombay Chartered Accountants Society (BCAS), who answers tax related queries on Moneylife Foundation’s Tax Helpline on a voluntary basis, said, “We need to ensure that all our emails, e-statements are saved systematically. If possible, maintain separate folders for different types of mails and maintain separate folders for different years. In addition, one can create separate folder inside the mail inbox like bank statement, credit card statements, insurance and I-T related mailers.”

Most tax filings and payments are now to be done electronically. Refunds are also issued electronically. Most banks, mutual funds, brokers and companies are sending warrants, reports, and notices electronically. In such an environment, it is important to preserve records, electronically.

The e-governance initiatives of the Indian government now cover electronic payment of taxes, filing of returns, appeals, payment of refunds, assessment and rectifications. Similarly, almost everything in share market, like demat account statements, contracts, applications, allotment, dividend and interest payment is taking place through the electronic platforms.

Banks and utilities like telephone and electricity services are also using this method to communicate with customers, he added.

He explained in detail on how the I-T departments assesses the income of taxpayer from electronic records. “Large amount of exempt income, large refund claimed in the return interest on bank FD, especially from co-operative banks, mutual fund investments, purchase or sale of immovable property, other large value transactions, including credit card expenses, large donations, capital gains from penny stocks, mismatch in TDS credit and large variance in income as compared to earlier year are main reasons for the taxman to select a taxpayer for scrutiny,” he said.

“While no tax is payable on exempt income, the onus to prove that such income is actually exempt lies with the taxpayer. And you need to disclose the exempt income, like interest and dividend income, in your I-T return form,” Mr Patel said, while explaining ways to preserve e-statements or e-intimations received for dividend income, capital gains, and maturity amount from insurance policy.

According to Mr Patel, it is so easy to get a credit card now and one can have multiple cards with multiple reward points. He said, “You use credit card to even pay for e-commerce transactions. You can have multiple bank accounts from which credit cards are paid through auto debits. You are provided with credit card statements by email. Do you know that credit card companies have to mandatorily report to the income-tax department? Do you know that e-commerce transactions leave a trail right up to your home? Remember, the tax department has full details of all your transactions.”

“For all expenses of a business, you need to have proper documentation. For all assets purchased, you need to preserve proper bills. In your ITR form, under certain circumstances, taxpayer is required to give ‘cost’ of certain assets. How will you give these unless you know what the cost is? How will you know the cost unless you have preserved the documents?” he added.

Many people who earn interest income from bank deposits either fail to mention it or pay required tax while filing ITR. “Interest on bank FD is taxable income,” Mr Patel said, adding, “Banks deduct tax deducted at source (TDS) on interest on FDs at 10% whereas you could be in the 20% or 30% bracket. This means that you ought to have paid the balance tax on your own. If not, then the taxman will ask you to provide complete details of your entire FDs in bank/s. In order to comply with income-tax requirements, you need to preserve your bank statements, fixed deposit receipts and keep track of renewals of fixed deposits.”

According to Mr Patel, we also need to preserve all correspondence with the tax department. He said, “We need to carefully preserve all the emails. We need to regularly check the form 26AS, intimations or notices that we may have missed out by going online on www.incometaxindiaefiling.gov.in. Also check the spam folder of your mailbox regularly so that you do not miss any important communication from the tax authorities.”

“Merely because you pay by cheque or credit card does not mean anything and you need documentary evidence to prove your claims. Remember, even our Army is being asked to give proofs of the Surgical Strike,” Mr Patel said in a lighter vein.

Mr Patel also answered a number of questions posed by a large and inquisitive audience.