A Will is a legally valid document that allows you to choose who gets your self-earned assets after your death. Any person who is not a minor and is of sound mind can make a Will and a person who dies without making a Will is considered Intestate. What is important while making a “good” Will is the content of the Will. After organising several sessions on Wills, Moneylife conducted another seminar on “The Essentials of a Good Will”.

Sachin Gupta, an advocate and partner at Negandhi Shah and Himayutullah, Advocates and Solicitors, who has wide ranging experience in matters of litigation, was the speaker of the event. He covered the topics related to intestate Succession, legal terms used while making a Will, types of Wills, including Conditional Wills, Joint Wills and Mutual Wills. He also discussed why it is important to make a Will, what probate is, and what the role of Trusts is.

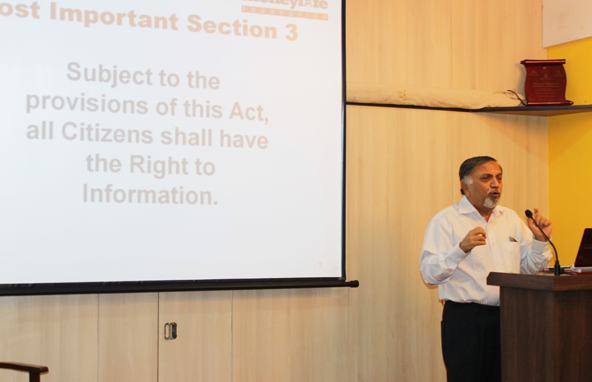

While talking about the laws governing Intestate Succession, he pointed out Acts which are followed in different religions. The Hindu Succession Act, 1956 applies to Hindus, Buddhists, Jains and Sikhs. The Indian Succession Act, 1925 applies to Christians. Parsis have their own Succession Laws. Muslim succession laws are not codified but are based on their religious texts. Shias and Sunnis have different inheritance laws. Muslims can make an oral Will and it does not need attestation. Armed forces engaged in war, or an expedition and Seafarers are permitted to make an oral Will or Privileged Will.

Explaining the simple reason of creating a Will, Mr. Gupta pointed out that a Will ensures proper distribution of assets as per your wishes and appoints executors or creating trusts for specific beneficiaries. Further, talking about the Trusts, he mentioned Trust can be registered under the Indian Trusts Act. Testator, who is making the Will, can transfer funds and property to the Trust which becomes the holding vehicle. Trustee manages the trust as per the trust deed. Further, testator can access and control assets while alive and decide on distribution too. A Trust is especially useful when you have to provide for a special child or have multiple families due to divorce/ re-marriage. It remains out of creditors’ clutches; confidentiality is maintained since beneficiaries are not disclosed. Trust carries highest taxes in India, plus administrative expenses. A trust protects assets from probate.