Recently with stock broking firms like Anugrah and Karvy being declared defaulters, many troubled investors have been scrambling for answers from regulators. Moneylife Foundation has created separate Telegram groups for Anugrah and Karvy investors, in order to educate them on the option they have available for recovery and the process of grievance redressal with the regulators.

Moneylife Foundation has been actively hosting webinars with regulatory and legal experts in this regard and one such session was held with Mr Nitin Ambure, Vice President, Operations at Central Depository Services Ltd (CDSL) and Mr Farokh Patel, Vice President, Audit, Inspection and Compliance at CDSL. This session was held with the aim to clarify what processes an investor needs to follow in case your broker is declared a defaulter.

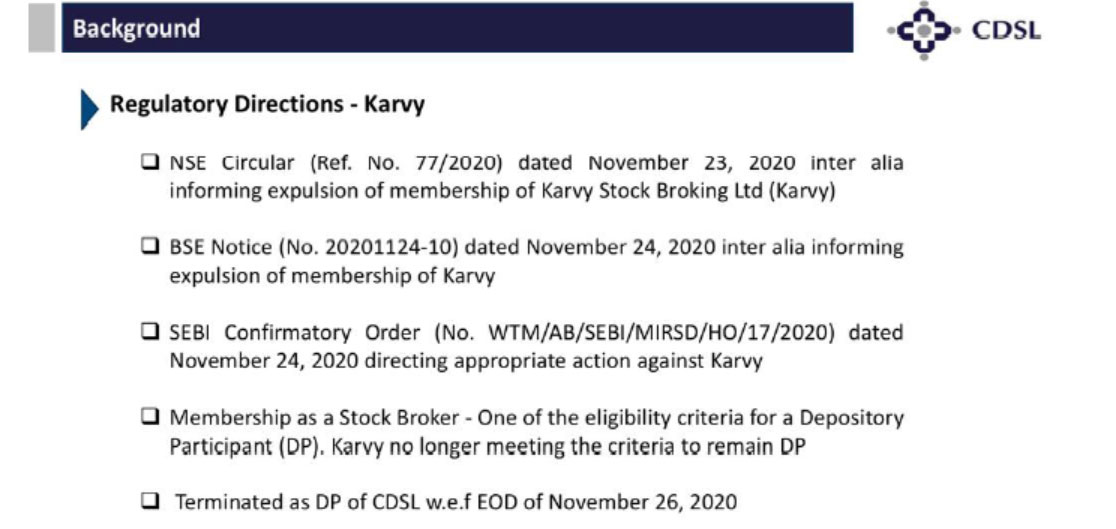

The session began with a brief presentation from Mr Ambure as he first systematically explained the actions taken by regulatory bodies in the cases of Anugrah and Karvy. While not going into details, Mr Ambure explained how both stock broking firms failed to meet the prerequisite of being a Depository Participant (DP) within CDSL, once they were expelled or trading was suspended in the exchanges.

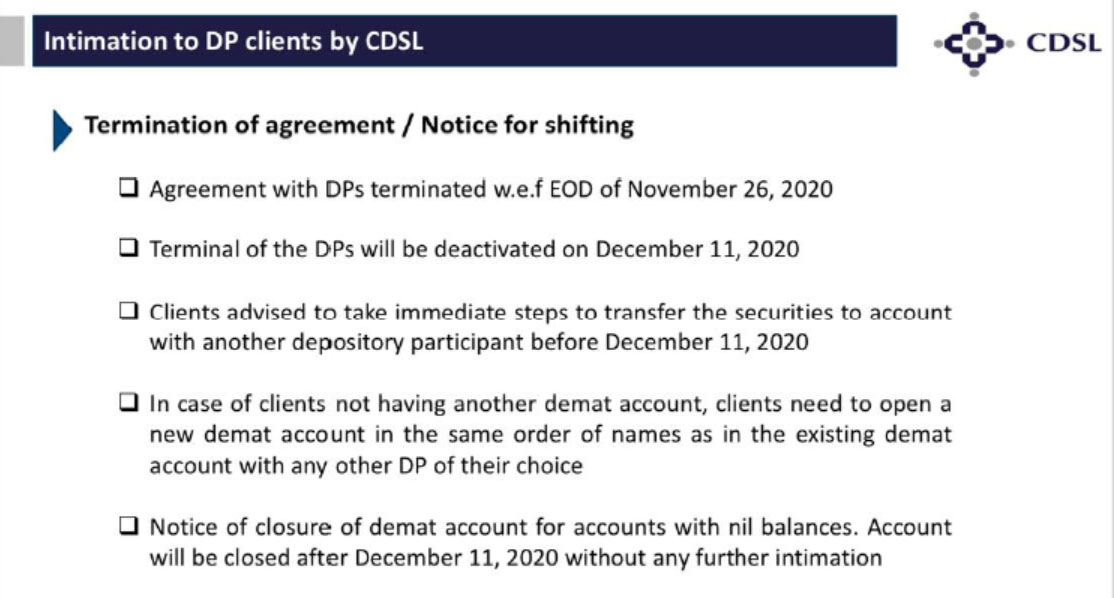

“As per the bylaws of CDSL, we are responsible to give a 15 day notice to clients of those DPs who are no longer with the CDSL. Thus allowing clients to transfer any securities to another DP by contacting the respective expelled DP,” explained Mr Ambure when asked about the 15 day deadline that was intimated to clients over mail.

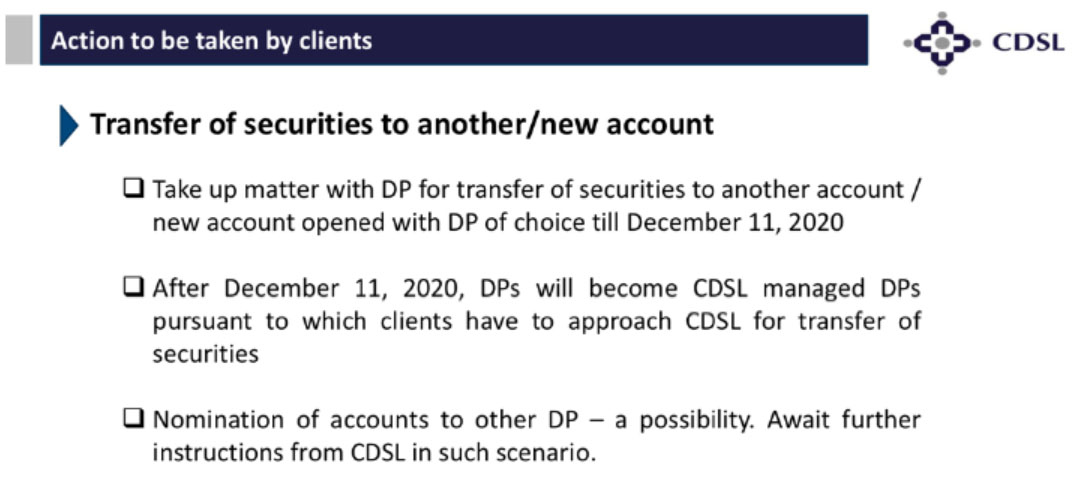

Explaining further on how a client can initiate transfer of securities from either Anugrah or Karvy, Mr Ambure said that, “Any client with only one demat account either with Karvy or Anugrah, can easily open another demat account to transfer securities to this new account attached to another DP. The process is very simple and has been explained on the CDSL website. Clients can have access to a list of DPs in their respective regions and can also see their related tariffs, in order to decide which DP is best suited for their purpose. ” Also, opening of a new demat account is also very simple and straightforward with only the requirement of a valid id and address proof, so in a sense “clients need not go to a DP’s office to open an account, the entire process can be completed from home”.

During his presentation he also addressed the fact that client demat accounts in the cases of Anugrah and Karvy which have nil balances will be closed after the 15 day period (post December 11, 2020), since the DP is no longer registered with CDSL and has been suspended on the exchanges.

Discussing the present actions that a client of either Anugrah or Karvy needs to undertake, Mr Ambure explained that they would first have to choose another operational DP and initiate transfer of securities within the 15 day notice period by taking up the matter with the concerned DP.

“Beyond the 15 day period, our CDSL bylaws also allow the DP to continue to cater to the needs of the investor in terms of transferring their securities to a new account, so investors need not necessarily worry about missing the deadline. Pursuant to our bylaws, after the 15 day notice period the DPs will also become ‘CDSL managed DPs’, so an investor will have to approach CDSL in order to initiate transfer of their securities,” he further explained.

After a brief presentation, Mr Ambure and Mr Patel spent some time in answering questions that were collated by Moneylife Foundation from the Telegram groups and shared with them in advance. Although many concerns were addressed during the presentation, Mr Ambure still took the time to painstakingly address and answer all questions from the participants.

If you would like to receive such updates about the activities of Moneylife Foundation, you can become a member for FREE and get regular updates from our newsletters.

A video recording of the session is available on our YouTube Channel and can be viewed below: