The covid pandemic while having human impact has severely hampered businesses and the loans they are burdened with, as the country struggles through several months under lockdown. The period of compete shut down has affected MSMEs the most, many of whom are struggling to survive. With the pandemic situation, the government had also recently made changes to the guidelines for non-performing assets (NPA) and the laws concerning bankruptcy.

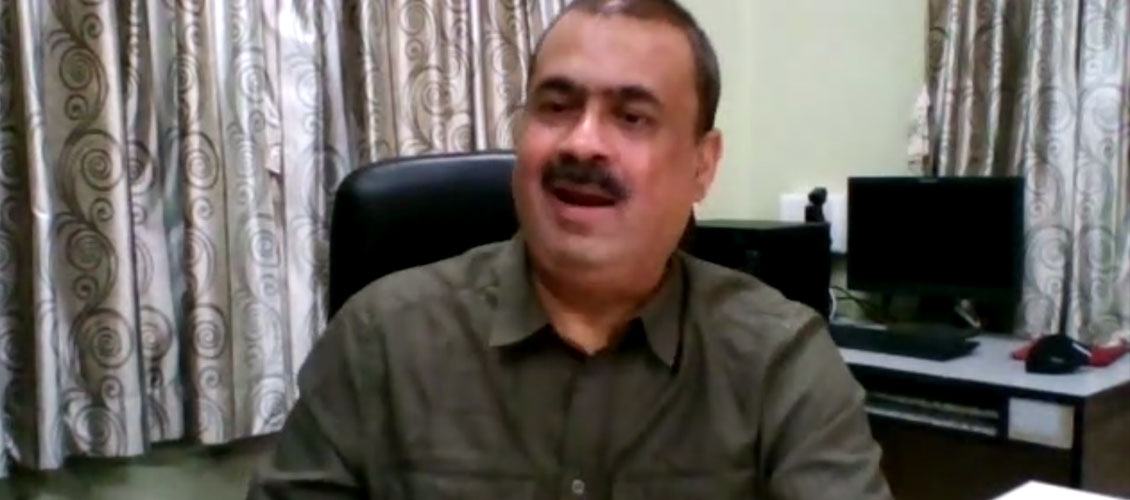

Moneylife Foundation had hence organised a webinar with Advocate Manoj Harit, whose law firm handles MSME cases on a regular basis. Through this webinar, Adv Harit attempted to explain the rules as laid down in RBI circulars and notifications as applicable to MSMEs and ventured on to comparatively explain how recent changes in the guidelines affect entrepreneurs.

By systematically going through each circular that the RBI had released amending the guidelines applicable for Non Performing Assets (NPAs) and also the rules concerning bankruptcy, Adv Harit successfully explained and highlighted the important laws applicable to a struggling SME or MSME during the lockdown period.

The webinar as well attended by several concerned members of the MSME sector and Adv Harit was also able to clarify various doubts during the Q&A session.

Video recording of the session:

Video recording of the Q&A session: