When the National Stock Exchange (NSE) expelled two brokerage back-to-back -- Karvy Stock Brokers Ltd and Anugrah Stock & Broking Ltd, it led to enormous panic among investors. Their initial complaints were now invalid and new forms had to be filled up to make them eligible for compensation from the investor protection fund (IPF). On seeing the distress and confusion over standard operation procedures (SOP), whether or not bank certificates and auditors’ attestation was required and where to get data, Moneylife Foundation approached NSE to hand hold investors. The Exchange to its credit readily accepted the request.

Moneylife Foundation on Tuesday organised another webinar with officials from the NSE’s Investor Services Cell (ISC). This webinar was led by Nisha Subhash, senior vice president for ISC at NSE and her colleagues Janardhan Gujaran, Gokul Swaminathan and Dinaz Shroff.

The webinar began with a brief presentation and handholding session from Mr Gujaran, who explained in great detail the procedures to be followed by an investor after their broker has been declared a defaulter. Starting with the types of claims an investor can file, Mr Gujaran went step by step and indicated how an investor can easily file a claim under the Investor Protection Fund (IPF).

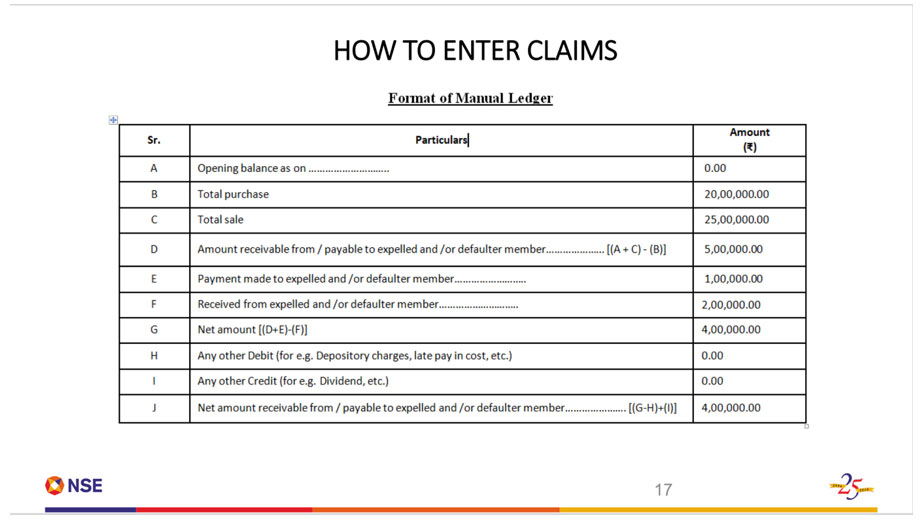

“The most important step for investors of Karvy and Anugrah at this stage, is to take note of their current standing and prepare a manual ledger, which needs to be submitted when filing a claim under the Investor Protection Fund. So, anyone who is looking at filing a claim should first take stock of their securities and trades, then prepare a detailed ledger which can support your claim,” explained Ms Subhash after the brief presentation.

Moneylife Foundation had also collated some queries from the investors on the Telegram groups and had shared the same with the officials from NSE in advance, with the hopes that the team would able to prepare and answer the same during the webinar. Ms Subhash and her team, spent a considerable amount of time in addressing these queries and also took the time to answer questions from the participants in the webinar.

Though not all questions could be addressed due to time constraints, many critical ones were answered and those interested can refer to the recorded video on Moneylife Foundation’s YouTube channel, YouTube.com/MoneylifeTV.

A video recording of the session is available on our YouTube Channel and can be viewed below:

If you would like to receive such updates about the activities of Moneylife Foundation, you can become a member for FREE and get regular updates from our newsletters.