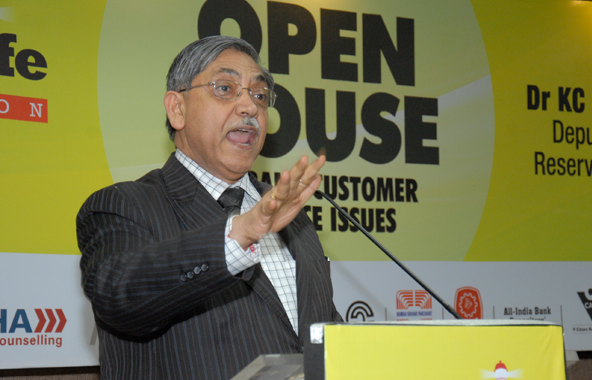

At a Moneylife Foundation programme today attended by a packed audience in Mumbai, the deputy governor of Reserve Bank of India (RBI) Dr KC Chakrabarty said that, “Customer service in banking is not negotiable, but customers must be aware about their rights. If customers depend on regulator for simple things like reading forms in details before signing blankly, then the banking system will not function”. He was speaking at an Open House in Mumbai organised by Moneylife Foundation.

“Customer is the most important part of a banking system and it is necessary that the bankers do not ‘squeeze’ customers. However, after saying this, we must understand that banking is not just a service but it is also a business and banks need to levy charges on services in order to survive”, Dr Chakrabarty said.

While accepting that mis-selling should not happen in banks, the RBI deputy governor said, “Mis-selling is same across banks and brokers and we need to decide to first identify what is mis-selling. For example, insurance penetration in our country is just 5-6%. However, even the highly educated people fall for ‘higher returns’, rather than the insurance and sign papers blankly”.

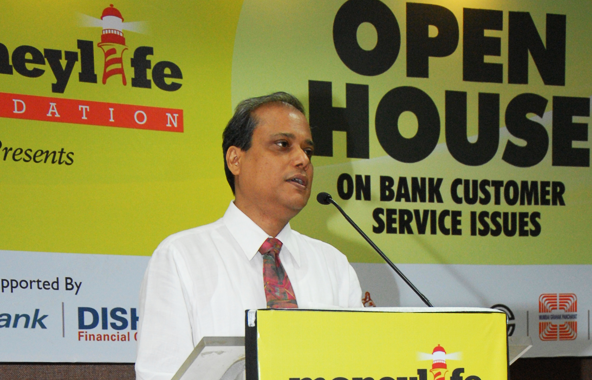

Earlier, while welcoming the guests, Debashis Basu, Founder Trustee of Moneylife Foundation and Editor & Publisher of Moneylife, said, “Ideally, banks should stop selling third Party Products: They often do not know what they are selling and do not care what happens to customers who buy them. There is no formal process of learning about a product, or about ethical selling. And they are never accountable for the outcome.”

Moneylife Foundation has been arguing that while bankers are supposed to stand for trust; they hold a lot of money on behalf of customers. “Yet, today, bankers are often being referred to as banksters for mis-selling third-party products or for rampant mismanagement of money under the garb of wealth management services. Insurance products, gold at higher than market prices with no buyback, and the worst of all, Wealth Management Products including unregulated products like Art Funds are all sold by banks by exploiting the depositors’ trust. Unfortunately, this often inflicts large losses on the hapless bank depositor,” pointed out Mr Basu. Moneylife has narrated several such cases. “As a consumer organisation, all we want is something simple and logical: we want bankers to be made responsible for what they sell,” appealed Mr Basu to the Deputy Governor.

Monelife Foundation placed before the Deputy Governor, a few submissions regarding third party products.

Selling process: If they continue to sell these products, a specific sign off by the customer on all clauses denoting risk factors and disclosure is a must. The BCSBI along with consumer bodies can be asked to work on these in a time bound manner but not more than three months.

Onus on banks: The onus of selling products appropriate to customers must be on the banks. Otherwise, they will keep selling a five-year locked in mutual fund to a 79-year old man. Or sell ULIP to a 60+ retiree, which requires hefty premium payments to be made for a five years before it starts making any returns at all.

Paper trail: Banks must be made responsible to create proof and trail mail/hard copy when relationship managers/tellers accost customers at home or at the banks. A clear email spelling out specific terms and pros and cons must be sent to the consumer.

Compensation: RBI must codify compensation to victims of mis-selling. Since the onus of proving appropriateness of products must be on the bankers, there must be detailed specified penalties when mis-selling is established.

Sale of gold: Indians love to buy gold and trust their bank. This can be a dangerous combination. On every auspicious occasion, such Akshaya Tritiya banks heavily advertise the sale of gold coins. Banks charge a huge premium over the spot price and also different banks charge different prices. Having sold, banks cannot buy back the gold they sell. It is only fair that if banks are allowed to continue sell gold, all these major drawbacks of buying gold from banks must be prominently displayed at the bank, the websites and the ads.

Mr Basu also pointed out that “the RBI has set up an elaborate system of customer services committees. A committee of the board, a standing committee, a branch level committee etc. We would be happy if there was an audit of whether these committees are actually formed, are they meeting, are customers encouraged to share their grievances and so on. If there is a yearly report of the functioning of these committees in the public domain with independent benchmarking, that would actually make the idea useful for customers.”

One of the many issues that Moneylife has taken up with the Reserve Bank of India (RBI) is the need for a technology audit of banks and the systems and processes that they adopt. Over the years, individual banks have often configured systems in a manner that hurt depositors’ interest. And, since technology changes are complex and outsourced, the process of incorporating even small, but necessary changes is both cumbersome and expensive.

Recently Moneylife wrote how SBI deducted 40% as TDS (System glitch deducts 40% amount as TDS from SBI depositors’ account! ). What is the reporting and monitoring system for this? HDFC bank was found regularly deducting TDS from the principal (Now, even your fixed deposit principal may be at risk). Surely, bankers are expected to know that tax is on income and can never be deducted from principal under any circumstances? It is even a violation of the RBI master circular. But the bank kept justifying it to customers with the argument that their systems are geared that way. Who will audit and fix these? Is there an annual audit on the robustness and correctness of bank IT systems?

This is certainly the thought process in the developed countries. From Australia to the US, many countries are now creating a separate agency, whose job will only be to regulate and supervise financial conduct and consumer protection across all financial products. India has started considering this too. Financial Sector Legislative Reforms Commission has suggested creating a consumer protection agency. Meanwhile, by June-end, we are supposed to get a new set of rules from the RBI, on wealth management and sale of third party products.