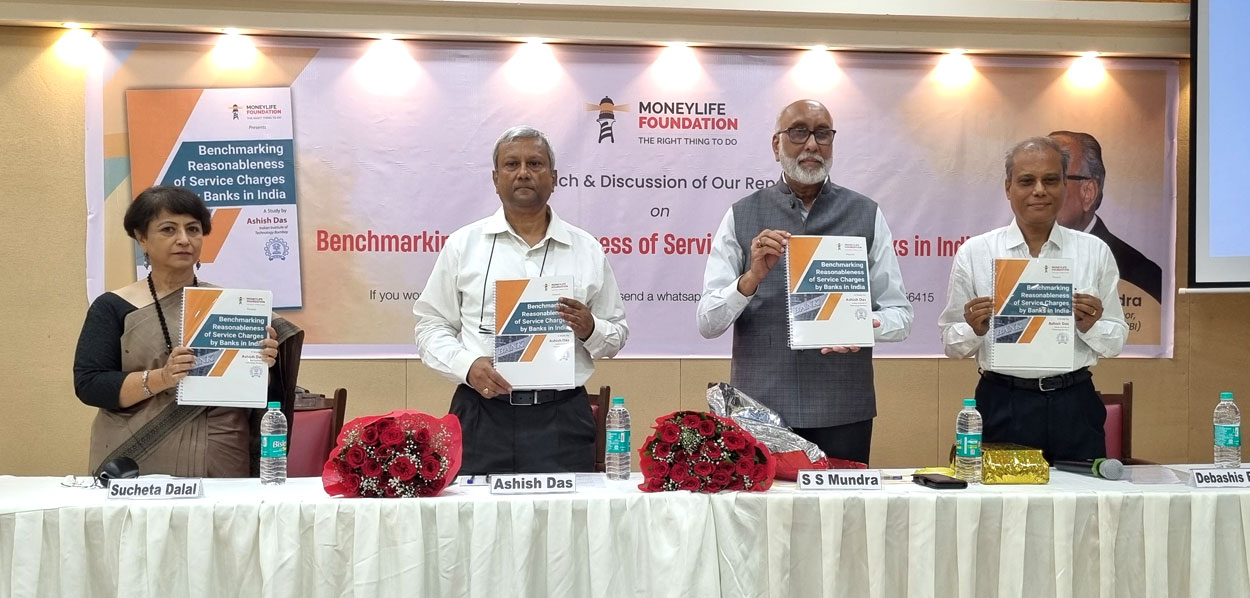

A pathbreaking new research uncovers substantial variations in service charges levied by banks across India on basic savings bank accounts. The study, "Benchmarking Reasonableness of Service Charges by Banks in India" authored by Dr Ashish Das from the Indian Institute of Technology- Bombay (IIT-B), and commissioned by Moneylife Foundation under a CSR initiative was released on Wednesday by SS Mundra, former deputy governor of Reserve Bank of India (RBI). The study sheds light on commendable practices as well as areas of concern in the way Indian banks charge for their services.

Releasing the study, Mr Mundra says, “There is a consumer charter available with every bank. Still we have seen in then study the service charges are not reasonable as envisaged by RBI. So where is the problem? I think the problem is not with the policy but execution of then policies defined. This Study shows the mirror on policy and execution.”

One area that the former deputy governor emphasised is allowing bank account portability. “This will empower customers to a great extent.”

Among the scheduled commercial banks (SCBs), only three came out on top (Category A). These are: IDFC First Bank, AU Small Finance Bank and Bandhan Bank. IDFC First Bank has 14 services where its charges are exceptionally low or zero. Next in terms of low charges is AU SF Bank, which does not charge for mandatory SMS alerts, charges less for online IMPS compared to at-branch IMPS and has a comparatively lower requirement for average monthly balance. Bandhan Bank is the only bank apart from State Bank of India (SBI) with zero average monthly or quarterly balance requirements. Separately, two large cooperative banks Saraswat Bank and SVC Cooperative Bank also have low charges.

On an average, charges at Canara Bank and Axis Bank are the highest, putting them in the lowest category (Category D). Canara Bank ranked lowest in the study for its extremely high service charges for services like 'DD Cancellation', 'Self-Generation of ATM PIN', 'mandatory-SMS alerts' and 'non-maintenance of average balance' in rural areas. Axis Bank has relatively higher charges, with a few outlier charges for 'non-maintenance of balance' in metro and urban accounts, 'non-financial transactions from own bank ATMs' and 'failed Standing Instruction’.

Among public sector banks (PSBs), State Bank of India emerged as the best but is still in the B-category. The scrapping of the controversial average quarterly balance (AQB) worked in SBI's favour.

Senior journalist Sucheta Dalal, who is founder trustee of Moneylife Foundation says, “We have presented this study to the RBI Governor and his top team and we are told that the report is being examined by the regulator. At Moneylife Foundation, we believe this information, expanded to cover every single bank, ought to be available on a public dashboard, so that anyone who plans to open a bank account, or wants to check if her bank is treating her fairly, can just go there and look for the information and make an informed comparison. Just as anyone can easily check and compare the performance of mutual funds. The Depositor Education & Awareness (DEA) Fund of RBI has plenty of resources to set up this comparative dashboard, if there is a will. It is up to us to make it happen.”

Gautam Thakur, chairman of Saraswat Bank, says, “We are a cooperative bank and as you may be aware, cooperative banks do not work on profit but on providing services to customers.”

“Today, we are in a vicious circle of showing more and more profit. But my question is how much profit is enough? Once you realise this, you will start working for betterment of the customers,” Mr Thakur added.

Until 1999, RBI prescribed what banks could charge for various services. Since then, banks have been allowed to set their own service charges, but RBI has emphasised that bank charges should be reasonable and linked to costs. A report by RBI nearly two decades ago (in September 2006) laid the foundation for discussions on ensuring the reasonableness of bank charges and identifying certain services as being fundamental to banking operations. However, there has been no detailed research on whether the principle of 'reasonableness' mandated by RBI is being followed by banks. The report provides examples of unusually high charges that are neither linked to costs nor are reasonable.

There was a preliminary investigation by IIT-Bombay (in 2009) and RBI's department of banking supervision conducted a thematic analysis (in 2020-21). These are unpublished and not in the public domain. Hence, no comparison or ranking is available and bank customers remain in the dark about the reasonableness of banking charges, resulting in a lack of transparency and accountability.

Prof Das says despite these efforts, the question of reasonableness of basic banking service charges remains a pressing concern, particularly in light of the significant transformations within the banking sector over the past 18 years. “In this context, I am grateful for the opportunity to present the findings from the detailed analysis of bank service charges in India and shed light on regulatory and supervisory actions in this domain. The report emphasises the need for a thorough assessment, justification and adherence to regulatory guidelines in fixing service charges. The report provides three case studies that are eye-openers,” he says.

The study exposes inconsistencies in adherence to RBI mandates; some banks impose charges that exceed reasonable limits. Based on service charge data obtained for a sample of 23 scheduled commercial banks (SCBs) and two cooperative banks, the key findings of the study are summarised below.

- General Observations: While private sector banks tend to impose higher average minimum balance requirements, public sector banks (PSBs) exhibit higher average charges across various services. Some banks impose extremely high service charges. These are: YES Bank (for 'Cheque Returned due to technical reasons'), Federal Bank (for 'Doorstep Banking'), Standard Chartered and Indian Overseas Bank (for 'Non-financial Off-Us ATM transactions') and Canara Bank (for 'DD Cancellation' and 'Self-Generation of ATM PIN'). Off-us refers to transactions done at ATMs and POS terminals of other banks.

- ATM/NEFT/RTGS/IMPS Related Charges: Wide disparities in ATM withdrawal charges are evident among banks; some banks adhere to the caps set by RBI, while others charge below or above these thresholds. Additionally, inconsistencies persist in charges for services such as NEFT/RTGS. Central Bank of India, Bank of Maharashtra, Bank of India and IDBI Bank, contrary to RBI advice, have failed to pass on branch-based NEFT/RTGS service charge benefits to customers.

- Charges for ATM/POS Decline due to Insufficient Balance: Many banks impose penalties for ATM/POS declines due to insufficient balance, with charges reaching as high as Rs25. Out of the 25 banks in the sample, 11 do not charge for POS declines (but charge for ATM declines) while 5 do not charge for both. The study raises questions about the rationale for such charges, particularly since failed transactions do not inflict any cost (the normal interchange charge) on the bank.

- Debit Card Annual Fees: Despite the declining significance of debit cards domestically, a majority of banks continue to impose annual fees. Of the 25 banks in the sample, 16 banks do not charge for debit card issuance, while all banks, except IDFC First Bank, impose debit card annual fees. The study advocates a review of the reasonableness of these fees, especially taking into account the large number of instances where cards remain unused.

- Charges on Mandatory-SMS Alerts: RBI has mandated SMS alerts for debit transactions done through UPI/NEFT/RTGS/IMPS and ATM cash withdrawals. Such SMS alerts become part of the product features of the withdrawal channels. Yet, some banks levy charges for mandatory SMS alerts. Ten out of the 25 banks do not charge for the mandatory-SMS alerts, and among the 15 banks that impose these charges, five do not have a monthly/quarterly cap on such SMS alert charges.

- Penal Charges for Non-maintenance of Minimum Balance: The study reveals inconsistencies in penal charges imposed by banks for non-maintenance of minimum balance, with some banks applying disproportionately higher charges. There are 14 banks having a slab structure wherein, for each slab, the penal charges are constant in rupee terms, i.e., they are not a fixed percentage of the shortfall even within each slab. These banks impose a disproportionately higher penal charge in the lower slab of shortfalls than in the higher slabs.

Using a rank aggregation method, 44 service-charge variables were analysed to rank all the banks in the sample. The banks were then grouped into four categories (A-D), with A being the best and D being the worst.

The overall analysis revealed some interesting results. Both Saraswat Cooperative Bank and SVC Cooperative Bank, performed exceptionally well, earning a spot in the top tier (Category A). However, being cooperative banks, they have very different customer segments, business models and regulatory requirements. Hence, for the purpose of eliminating any undue effects of these two cooperative banks in the rankings, only a sample set of 22 SCBs was considered when ranking the banks with respect to service charges.

This sample set also leaves out Standard Chartered Bank, as it is a different class of bank and does not have a presence in semi-urban and rural areas. While charges levied by Standard Chartered Bank are analysed in the report, it has not been considered in the overall rankings.

Based on their service charges, banks are ranked in the report as follows:

Category A (Best Performers):

• IDFC First Bank

• AU SF Bank

• Bandhan Bank

• Saraswat Cooperative Bank

• SVC Cooperative Bank

Category B:

• State Bank of India

• RBL Bank

• Ujjivan SF Bank

• HDFC Bank

• Bank of Maharashtra

• Punjab National Bank

• IndusInd Bank

• Union Bank of India

• Bank of Baroda

Category C:

• Central Bank of India

• IDBI Bank

• Bank of India

• Kotak Mahindra Bank

• ICICI Bank

• Federal Bank

• Indian Overseas Bank

• Yes Bank

Category D (Worst Performers):

• Axis Bank

• Canara Bank

The study also provides insights from case studies, highlighting regulatory actions and supervisory inactions concerning unreasonable service charges by some banks. This underscores the need for greater oversight and accountability in the banking sector.

In the light of these findings, the study offers the following recommendations:

1. RBI should conduct a thorough review of the issues highlighted in the report, focusing on the reasonableness of service charges imposed by banks.

2. Regulatory observations made through case studies should be addressed promptly to ensure fairness and transparency in banking practices.

3. Banks should prioritise customer-centricity, rationality and adherence to regulatory guidelines when fixing service charges.

4. Greater oversight and accountability mechanisms need to be established to safeguard the interests of bank depositors, particularly marginalised ones.