“Protecting, properly preserving and quickly retrieving decades old personal papers within minutes is not a rocket science or magic. Anyone can do it by following simple methods systematically and regularly. However, while doing so, we must understand the importance to locate and discard old and non-relevant documents,” says PR Balan, Chief Mentor of MFA Consulting Pvt Ltd. He was speaking at a special seminar on “Sail Through Tax Scrutinies With Watertight Documentation” organised by Moneylife Foundation in Mumbai.

Mr Balan, who is uniquely obsessive about documentation with amazing results, says once you discard irrelevant old documents, what you will get is most relevant and important set of documents. “When we talk about preserving tax papers, many see this as a pain. Especially for tax scrutinies, there could be reasons like anxiety, fear, stress or tension behind this. However, this should not become a hindrance in maintaining and preserving tax records,” he added.

He feels there is a built-in inertia, especially among people from technical or creative fields while dealing with papers. Mr Balan says, “Digital revolution makes people feel that they can manage without papers. So they allot less or almost nil quality time for paper management. Many even have a wrong notion that they can ‘manage’ any situation. In addition, our educational curriculum does not emphasize on documentation – rather ‘paper management’. This needs to be drilled in every child’s mind.”

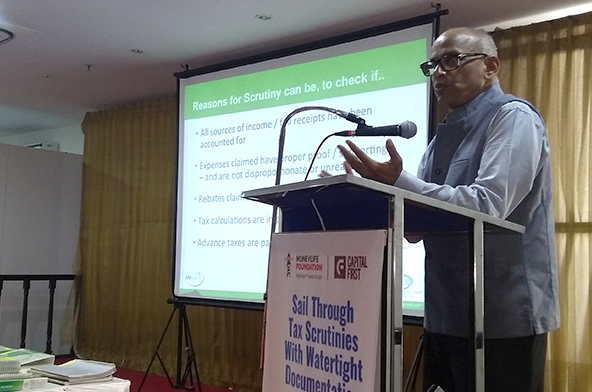

During a scrutiny from Income Tax department, many taxpayers assume this to be painful. “The reasons for this could be their in-ability in answering queries from the taxman or inability to provide proof or supporting documents. Some may not be paying adequate attention on tax matters, while few may not supply complete information to their Chartered Accountants (CAs). However, most prominent reason is poor paper management,” Mr Balan said.

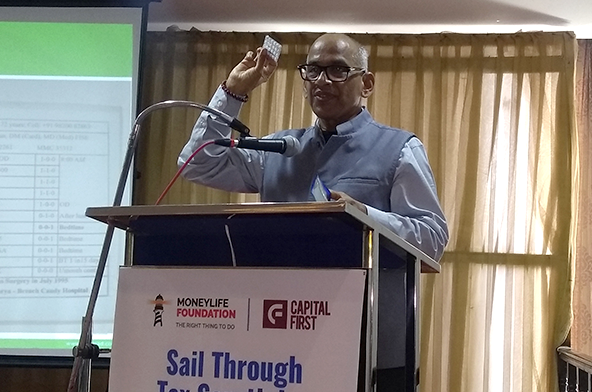

Queries from the tax department can range from checking source of income, receipts, claims of expenses, rebates, and mismatch in tax calculations and advance tax paid. “For your I-T file, you should have documents like ITR acknowledgement from previous year, income statement for current year, Form 16 and 16A, bills raised, cash or cheque vouchers, bank statement, advance tax challans, TDS challan for remittances, TDS certificates received, and investments for I-T rebate,” he added.

Mr Balan suggests creating and maintaining an excel file for recording all professional and other income with relevant details like payer’s name, purpose of payment, gross amount, and net amount. “Compiling such a statement at the end of the year will be cumbersome, difficult and time-consuming. Hence, we should do it on regular basis, preferably on monthly basis if not on a weekly basis. Such a statement will help you establish the total income easily,” he added.

Many taxpayers have multiple bank accounts and while filing tax returns they find it difficult to check each statement. Mr Balan suggests maintaining only two accounts, one for business or professional purpose and other for personal transactions. He says, “Keep print-outs of bank statements in a separate files or one file with dividers for different accounts. Maintain your bank statements in chronological order – in voucher or cheque number sequence in the same format as the bank passbook – but with clear details of payee’s name, purpose of payment, date of issue of cheque, and date of debit by the bank. If you make it a habit, it will have tremendous advantages!”

Sharing some tips on managing important documents, Mr Balan, said, “Handle it with care and respect – because it needs to be preserved and used later. Do not fold or roll or crumple papers like a bhel-puri vendor. For thermal paper bills, take photo-copies and affix the original aside of photo copy or on the reverse. For bills in small size like fuel bills, paste several bills on an A4 size paper since it makes it less bulky and easier to carry, punch and file it. Thin papers should be pasted on a bond paper to strengthen them.”

Mr Balan suggested use of box files for preserving records of all documents, which he feels can be stored vertically for easy retrieval and one can add or remove any document from in between the file. “Documents like a birth certificate or marriage certificate should be laminated. This increases life of these documents. For papers that cannot be punched, we should use sleeves. Also use file clips, dividers and Alcon trays for separation,” he added.

Highlighting importance to discard un-important or unwanted documents for preserving important ones, Mr Balan said, “Many people say ‘I have all the papers from 1970 onwards’ – this is the problem! In addition, it is a wrong notion that preserving or maintaining documents is a job of an office boy or filing is below one’s dignity. Do it yourself. It has tremendous advantages, like you will exactly remember which document is kept where.”

For health related issues, Mr Balan advised to create and maintain a medical file. He says, “This should include medical history and documents of past two years only, except those like a blood test reports. Also carry a medical identity card and telephone numbers of immediate family along with you all the time.”

Mr Balan also shared some tips on maintaining emails by creating separate folders or sub-folders depending upon the set criteria and also delete periodically unwanted mails from the mailbox.