India faces an urgent need for legislation to manage the finances and care of incapacitated adults. With an ageing population, seniors who may be mentally or physically incapacitated lack the capacity to direct using their savings towards necessary care without legal guardianship. The current legal framework in India does not address situations where individuals suffering from conditions such as dementia or being in a comatose state are unable to manage their assets for their own care and living expenses. In the circumstances, Moneylife Foundation and a diverse group of experts advocated legal reforms in India for adult guardianship.

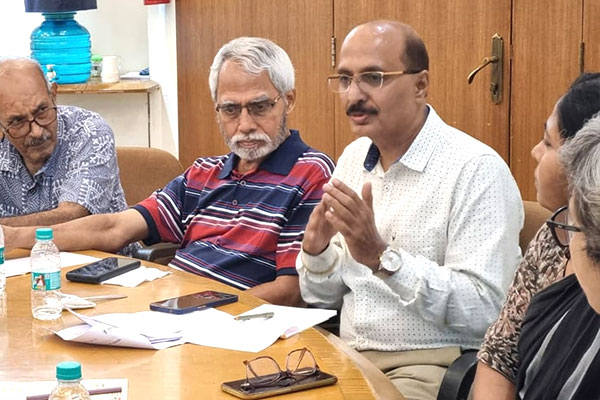

On 30 September 2024, Moneylife Foundation held an educational and awareness meeting focused on the pressing need for a legal framework governing adult guardianship in India. This initiative stems from the Foundation's comprehensive report on 'Challenges in Transmission of Assets to Nominees and Legal Heirs,' which highlighted the growing problem of unclaimed assets and problems with transmission of assets.

The session brought together a diverse group of experts, including consumer activists, legal professionals, heads of senior citizen organisations and members of the social sector.

These experts contributed to the rich discussion, sharing their perspectives on the current challenges families face when dealing with incapacitated adults and the inadequacies in India's legal framework to address these issues.

The absence of comprehensive laws has left families struggling, often turning to courts for redress. "There are senior citizens who have their own money and have paid taxes for most of their lives; they are not looking for help from the government, but they need a legal framework to protect them and ensure their own funds are available for their care if they become incapacitated."

Nishit Kumar, founder of the Center for Social and Behavior Change Communication proposed drafting a framework and conducting consultations with key stakeholders to ensure a robust system is put in place. He spoke about the challenges involved in drafting a new law and his own experience of working on a legislation to protect children from sexual abuse and exploitation.

A key challenge identified in the discussion was the need for a clear definition of 'incapacitation,' with Dr Professor Saigita, of the Tata Institute of Social Sciences (TISS) pointed out that many judges lack an understanding of the nuanced aspects of disability and incapacitation. "The judges are not aware of all the crucial aspects that define disability or incapacitation. They simply do not understand and that awareness is not there. Different countries have different criteria for defining disabled or incapacitated persons, both mentally and physically. We need a correct and inclusive definition that reflects the realities in India. Our first step should be to present a robust definition of incapacitation to provide clarity and ensure that appropriate guardianship is granted," she explained.

Dilip Modi, a member of Moneylife Foundation, who attended the meeting to share his experience with the UK's lasting power of attorney (LPA) system, highlighted the efficiency of the digitised framework for adult guardianship while also acknowledging the time it takes to process registrations.

"My personal experience is that I don't need to run from place to place when I am incapacitated because my guardians or deputies are already aware of my power of attorney. They have an online registration, and all they need is a code to access it. Institutions, whether property or banking, are legally obliged to follow the instructions of the guardian, making the process quick and efficient. It took me about seven months to get my LPA registered. But once that is done, the system works very smoothly," he says.

The participants arrived at a consensus that a national framework should be developed, akin to those in developed countries, outlining the process of appointing guardians and monitoring their activities. Existing laws and regulations in developed countries would be studied to form a basis for the framework, ensuring best practices are adopted in the Indian context. The need for medical and psychological experts to be consulted was also discussed, with participants emphasising the role of psychiatrists and psychologists in helping define the scope of incapacitation.

Mr Sailesh Mishra, founder of Silver Innings suggested the formation of a focused group of experts and NGOs (non-government organisations) who could work on drafting a framework and action plan to push for legislative reform on adult guardianship. This was seen as a vital step in ensuring that the issue is brought to the attention of policy-makers.

This discussion is part of Moneylife Foundation's broader educational initiative to raise awareness about unclaimed financial assets and the complexities surrounding asset transmission. The urgent need for legal reforms and strong legislation on adult guardianship is at the forefront of this effort. Through this initiative, Moneylife Foundation aims to ignite meaningful dialogue among policy-makers, regulators and industry leaders, pushing for much-needed change in the legal framework.

Notable attendees included: Nishit Kumar, founder of the Center for Social and Behavior Change Communication, Javed Sheikh, chief executive officer (CEO) of Dignity Foundation, Sailesh Mishra, founder of Silver Innings Foundation, Nasreen Rustomfram and Dr C Saigita, professors from Tata Institute of Social Sciences (TISS), Adv Jamshed Mistry, Harsh Roongta, founder of Fee Only Investment Advisers LLP, Dr Ketna Mehta, trustee of Nina Foundation, Dr Rekha Bhatkhande, Dean of Sushrusha Hospital, Rekha Kuruvialla and Advocate Aditya Joby founders of Will & More, representatives of Federation of Senior Citizen's Organisation of Maharashtra (FESCOM), several other professionals from legal, financial and social sectors.