Speaking at the open discussion on “Budget and You” organised by Moneylife Foundation on Saturday, Ameet Patel, president of the Bombay Chartered Accountants Society said, “This Budget proves that the finance minister is willing to listen to investors and taxpayers on various issues. It is a substantial departure from the past Budgets. I believe that if the minister continues to take bold decisions, Indian taxpayers are in good hands. The proposals on individual income-tax slabs mean that savings are going to flow into consumer goods and investments.”

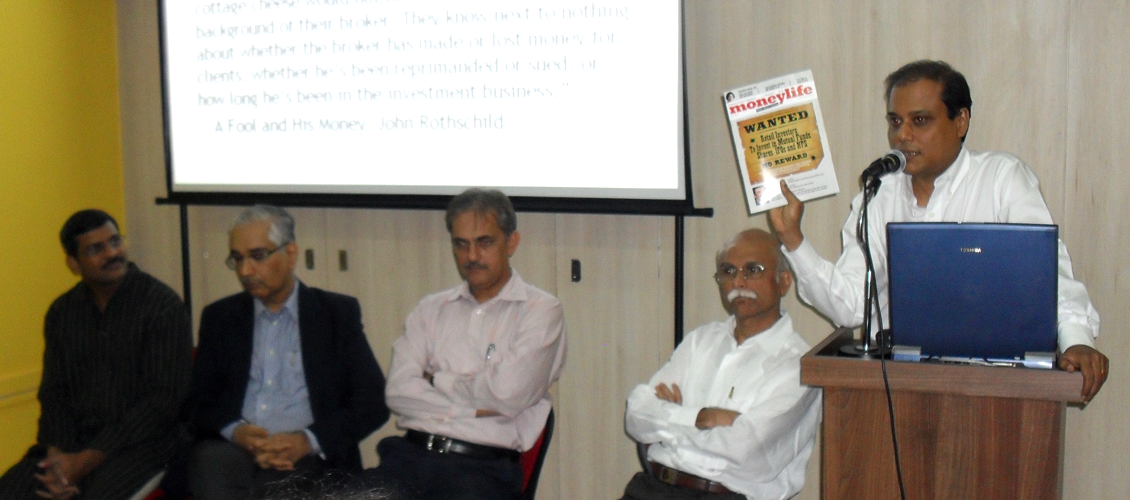

The discussion saw an interesting and enlightening exchange of opinions as the panellists for the discussion analysed and debated every aspect of the Budget and the National Pension Scheme (NPS). The participants and audience were presented with a detailed analysis of the implications of the Budget proposals for the common man, businesses as well as the entire economy.

Apart from Mr Patel, the panellists for the discussion included Saumil Trivedi, an expert at both technical and fundamental analysis; Rajesh Krishnamoorthy, managing director of iFAST Financial Private Ltd; and Gul Teckchandani, a much-sought-after speaker and commentator on markets.

Speaking about some of the other Budget decisions, Mr Patel said, “On the Direct Tax Code (DTC), there are many mistakes in the proposals which need to be addressed. Representations have been made to the ministry. Hopefully, things will be worked out soon. The Goods and Services Tax (GST) will make life simpler for businessmen and end-consumers.”

Mr Trivedi said, “We are at an interesting juncture in the stock markets. I believe that when it comes to the markets, people only depend on hindsight analysis, rather than thinking on their own. But the fact is, the only reliable truth available in the markets is the current price at which it is trading. People have to understand how prices move—whether they are showing strength or weakness. If you are a long-term investor, you have no business looking at the daily price points.” Summing up his presentation on market trends, Mr Trivedi said, “Be very cautious. Don’t be in a hurry to buy into the markets just because the Budget appears good.”

Mr Krishnamoorthy said, “The Budget is fantastic from the macro perspective; but certain micro issues like education and healthcare reforms need attention.

Also, it is disappointing that the government has not taken any tangible steps to tackle food inflation. However, the government’s move to allow deduction on investment in long-term infrastructure bonds is a welcome step. It is crucial that long-term savings in the country are channelized towards infrastructure.”

Mr Teckchandani spoke about investors’ attitudes to investments and how greed is a major factor in getting the timing of investment and exit all wrong. He also observed, “This Budget is definitely better than previous ones. It will leave more money in the hands of the common man. It will spur economic growth. But inflation still remains a cause for worry. As regards the stock market, I believe it is in a consolidation phase, irrespective of the Budget proposals. It will move in a narrow range from here on. In the next four years at least, I expect the market to double.”

About Moneylife Foundation:

Moneylife Foundation is registered as a not-for-profit trust and intends to engage in spreading financial literacy through workshops, round-table meetings and awareness campaigns; advocacy to crystallise policy and bring about regulatory changes to protect investor rights; and grievance redressal, counselling and research. The Foundation is offering free inaugural membership.